Textiles go green to drive impact

No more fashion victims

Green is the new black, sustainability is in fashion. The slow fashion philosophy, adopted by many of today’s fashionistas in all corners of the world, is based on longer utilization of textiles, better durability, higher quality, ethical production, as well as being environmentally friendly.

The desire and public commitment of larger companies to make necessary changes towards more sustainable practices is becoming more and more concrete. Doubtlessly pushed by regulatory drivers forming a serious threat to traditional productions and current practices that are still very fragmented. However, is our world, and its budding circular economy, ready to face the challenges of our heavily fragmented supply chains and, more importantly, our mindset?

One of the industries that is important to the investment strategy of ECBF (European Circular Bioeconomy Fund) are textiles, as they have substantial environmental and social impact. Textiles are responsible for 4-7% of global water usage, 2-5% CO2 emissions and 60 mmT waste produced every year. During our latest Deep Dive Session, we reviewed sustainable movements in the fashion industry, and identified some of the most prominentstart- and scale-upsthat are accelerating innovations in the value chain. A massive topic considering its complexity, diversity, and the vast number of influencing factors.

For the purpose of the article, Jowita Sewerska and Jisk de Vries from ECBF exchanged with industry voices: Rogier van Mazijk (Investment Director at Fashion for Good), Nadine Wortmann Resetarits (Board Member at Wortmann Family Foundation), Andreas Burmeister (Head of Corporate Sustainability at Wortmann KG), and Christine Goulay (Global Director B2B at Pangaia). The overview was complemented by a startup perspective from Greg Stillman (General Manager at Natural Fiber Welding) and Orr Yarkoni (CEO at Colorifix).

Lay of the Land

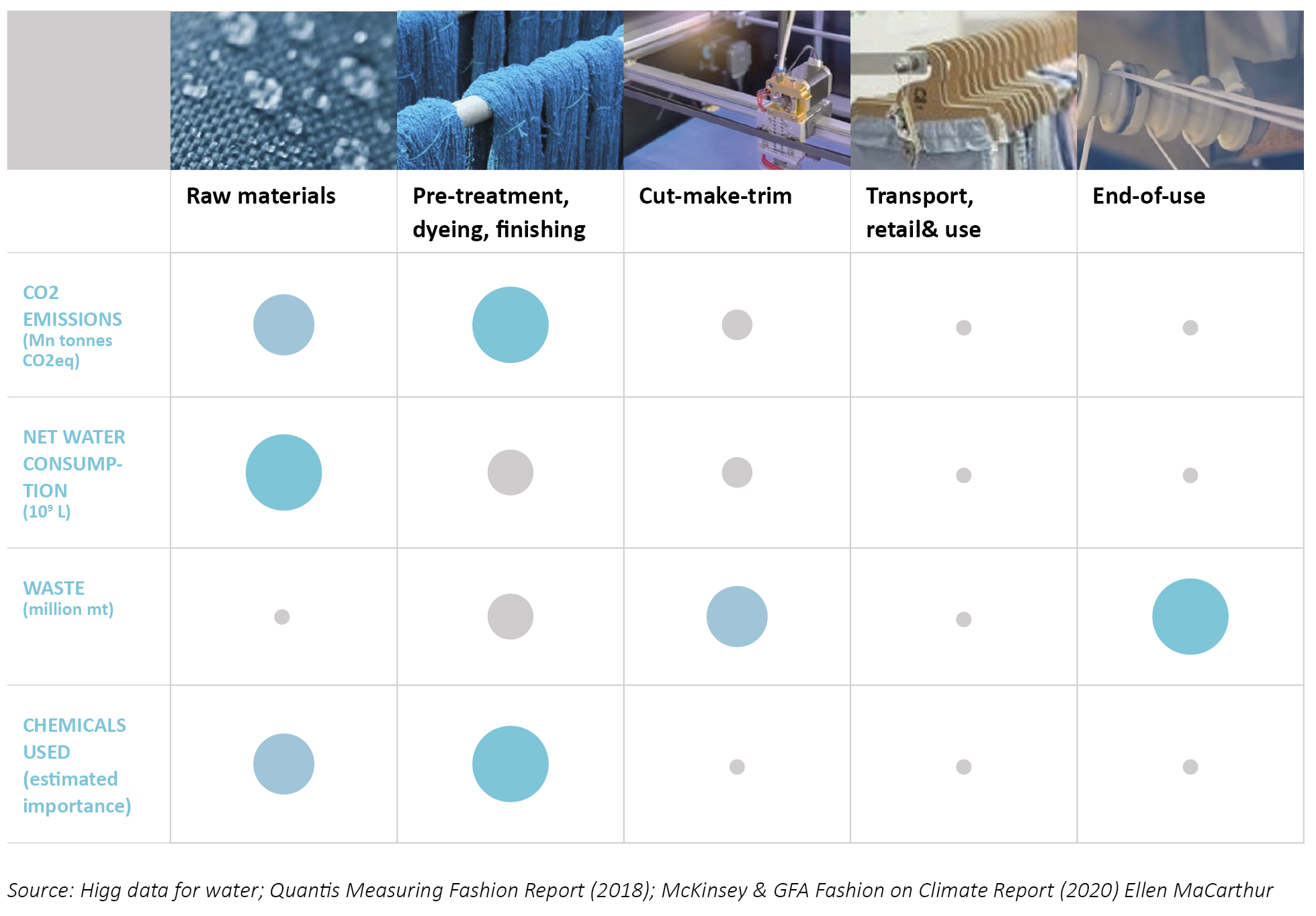

Creating an overview of the industry of catwalks’ value chain is no cakewalk. Implementing changes in the textiles value chain is complex as one step influences another. Generally speaking, we distinguish a few main steps, each with its own particular challenges of current practices versus market dynamics: Raw materials, consuming an excess of net water; pre-treatment – dyeing – finishing, producing the highest co2 emissions in the value chain and waste of used chemicals; cut-make-trim, with a reasonably small output of waste; transport-retail-use being the least impactful step in the chain; and end-of-use with high volumes of waste that end up in landfills or incineration ovens.

LARGEST ENV. IMPACT IN MATERIALS, PROCESSING & END-OF-USE

Each of the value chains impacts differently and knows different limitations. Within raw materials, currently 50-60% of fibers are fossil-based, whereas water-consuming cotton takes another 20- 30%. Mostly due to the properties of the materials (light, flexible, breathable, soft feel, durable) and relatively low price points, these two categories appear the most popular. An additional subcategory here is animal leather, where the tanning process especially poses a health risk to people engaged at this step, as well as to the environment, because of the use of toxic chemicals.

With pre-treatment, dyeing and finishing, a massive amount of chemicals is used. At the moment, most of them are produced through a petrochemical process because of low costs, high reliability, a wide range of options (e.g. colors of the dyes), great compatibility with existing materials, and durability. The application process itself usually entails using high temperatures and many MWh of electricity, as well as significant amounts of water for multiple turns of applying products to achieve certain effects. Taking all of this into account, added to the fact that the production and application process are usually based in countries with a heavy coal-fired energy base, it means that this step has a significant carbon footprint.

Cut-make-trim is a relatively manual step in the process. Labor conditions are key, the environmental impact is lower. Policy trends to improve monitoring in the factories are implemented more and more to prevent human rights violations such as child labor and modern slavery, and working in conditions that pose a health and safety risk. There is still a long way to go though, including accepting lower margins for brands and higher pricesfor customers to accommodate the costs associated with the necessary changes in this step.

Transport, retail and use have a relatively low impact compared to other value chains. However, during this phase, the previous steps are also implicated. For example, when washing materials with plastic ingredients (PET fibers, synthetic dyes or finishing chemicals, fossil-based sewing threads), microplastics are released into the water. In current water treatment plants, microplastics are not filtered, meaning that we consume these compounds by drinking tap water. The same is of course true for animals and plants.

To end the use of textiles usually means to incinerate or landfill. Recycling is complex, as this is not just about collecting the waste at dedicated points, but also about applying appropriate technologies to recover the raw materials. For the latter, there are two main options: mechanical or chemical recycling. As to mechanical recycling, it may prove challenging to extract the raw materials if the fibers are blended, or if there are chemicals applied to them. The chemical process may do the trick, but there is a limited number of substances that will work with most of the materials. The recycling process thus depends on how the material was manufactured, with what chemicals, and how the different mixes of fibers are bound.

Worth mentioning here is that only a couple of years ago, it was difficult to automate the sorting process to actually determine what the textiles are made of. Currently, there are emerging technologies (acting as digital passports, attached to the apparel), but it takes a couple of years before the given material closes the loop, and it requires a substantial scale to make the initiative meaningful.

Slow Fashion

Slow is not necessarily the opposite of fast, but a different approach in which designers, buyers, retailers, and consumers are more aware of the impacts of products on workers, communities, and ecosystems. It aimsfor a world in which sustainability is no longer considered an idiosyncrasy, but a matter of course, incorporated into the design ethos, throughout the value chain

“Buy less. Choose well. Make it last”

Three factors play an important role in innovating the textile space. On the one hand, there is a clear need to re-evaluate the textiles value chain as it is evidently polluting, wasteful, and unsustainable, and unable to help industries reach net zero objectives. Then, there is increasing consumer demand for more conscious and environmental clothing products as they gain awareness, and a corresponding strong interest of brandsto profit from strategic and marketing benefits, and gain access to the growing market of sustainable textiles.

Rules of the Game

Unethical fashion points to very little transparency, accountability, and knowledge of the value chain, to very quick lead times, and production turnaround. Production facilities are most commonly located in countries with poor regulation and innovation infrastructure.

Stricter regulation in the world of fashion, both in on- and offshore production, will ensure value chains are supported by a framework of soft laws, and supervised through a set of hard laws, that at times prove hard to uphold, but also to adhere to. A policy framework with economic incentives for sustainable innovation combined with regulation putting pressure on the current value chain is still in the works. Despite the fact that the EU has proposed an EU strategy for sustainable and circular textiles.

In the end, business initiatives are launched with the objective to make money (directly or indirectly), and any obstacles on the road to that objective mean a delay in reaching it, or a considerable decrease. That said, brands and value chains in the textile space are increasingly committed to innovating and even re-shoreing their activities.

“In the long run we are all dead. Economists set themselves too easy, too useless a task if, in tempestuous seasons, they can only tell us that when the storm is long past, the ocean is flat again.”

Brand Influence

Traditionally, the textile value chain was a fragmented one with little vertical integration. Current developments see trends to combine different steps for efficiency purposes, but also to expand the offer to the brands. Still, this is an ongoing process, and the brand owners remain the main beneficiaries of innovation asthey profit from the marketing of differentiated products. Because suppliers and processors are positioned early in the value chain, they do not benefit as much from these strategic or branding benefits, and have less incentive to support and use these disruptive technologies.

Customers hold sustainably produced products in high regard, more and more so, and brands do sincerely endeavor to change the social and ecological footprint in the value chain on a global scale. They experience higher scrutiny compared to ever before in history, from supervisors as well as consumers and potential influencers. Nadine Wortmann-Resetarits states: “As a family-run business our activities are designed to outlast for the generations to come. We want to play an active role in shaping the future through sustainable projects and take over responsibility.

Innovation Gap

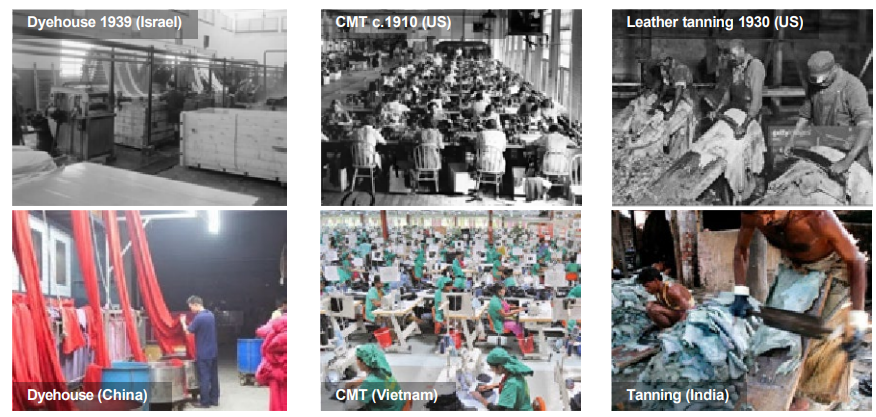

The textile industry is one of the world’s oldest, and true innovation is rare. The lack of progress and innovations in the textile industry is made painfully clear in the image below, presented by Rogier van Mazijk. Still mostly driven by manual labor, industry activities were offshored in recent decades because of lower cost.

“Don’t spend time beating on a wall, hoping to transform it into a door.”

Source: Presentation Fashion for Good

Heavy research in recent years is bringing a likely wave of textile-tech solutions to the market, with a high impact potential. Meaning, they may fill the innovation gap we find ourselves faced with. It is a relatively new space with a lot of new and relatively small successes. However, “if these solutions can scale up, it should work out well for our net-zero objectives,” Rogier van Mazijk laid out. Notably, the closer the new initiatives towards sustainable practices are to the current application process, the more similar properties they have, the higher the probability that they will find acceptance from market players.

Materials Science

One of the leading innovators that joined our Deep Dive is the material sciences company Pangaia, represented by Christine Goulay. Where most traditional solutions and innovations create brands and look toward others to implement them in production, this company is a direct-to-consumer brand that aims to support fashion-brand partners in becoming Earth positive by providing a turn-key solution to uptake innovations throughout the value chain, such as sourcing easy-to-adopt raw materials, dyes and finishes. Their model includes proprietary technologies like FLWRDWN, an alternative to synthetic and animal-based down. Through partnerships with suppliers (e.g., dyehouse, fabric mill), Pangaia is able to streamline the R&D process and ensure success from the get-go. “We also research whether a product resonates with consumers: Is it something they can relate to. Meanwhile, we try to push consumer demand by using high-profile influencers,” Christine shared. ECBF concluded many celebrities with a big audience are active in the sustainable textilesspace – an unmistakable opportunity to create awareness on a broaderscale.

There already are successful start-ups that are doing well in this arena. One of them, active in the materials’ space, is Natural Fiber Welding (NFW) that is producing plant-based, all-natural, zero-plastic, performance materials for some of the largest brands reaching consumers. The two current main products are Mirum, ingredient branded replacement to leather and polyurethane, and Clarus, ingredient branded line of high-performance fabrics competing with virgin cotton and fossil-derived material like polyester. Greg Stillman: “We turn natural fiber into something that features like a performance polyester product to deliver not just an all-natural experience, but tangible material benefits.”

The second start-up is Colorifix, using an entirely bio-based process to produce, deposit, and fix pigments onto textiles, revolutionizing dying of materials. Colorifix uses synthetic biology where dyes are produced by bacteria through a biological process, contrary to the current standard of petrochemical dyes. Despite setting up promising trends themselves though, “the challenge remains to find the real sustainable products in this arena,” commented Orr Yarkoni.

Investment Landscape

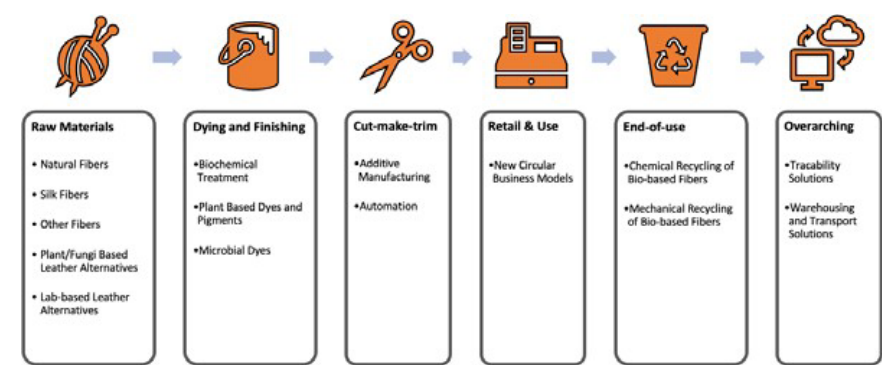

To provide insight into the venture dynamics of the space, ECBF focused on areas that are connected with ECBF’sinvestmentstrategy, centralized around bio-based technologies. There are therefore three steps from the value chain above that we took into account: Raw materials, dyeing and finishing, and end-of-use.

Source: Fashion for Good - Sustainable Textiles Value Chain

The analysis of the venture dynamics in these three steps in the value chain was based on ECBFs extensive database of start-ups. When looking at the total funding raised by the start-ups in this sector, ECBF sees that the US-based startups have accumulated more funding and seem to be more mature than European competitors. This finding is supported when looking at the closed funding rounds, with US-based companies completing later stage rounds. However seeing the large number of early stage start-ups emerging in Europe it is easy to see that Europe is developing into a meaningful hub for sustainable textile innovations.

It is challenging for disruptive technologies to reach competitive pricing because the textile materials and processing market is highly optimized and commoditized. Furthermore, the fashion industry has not been a technology- or innovation-driven industry, historically, and demand for new solutions has accelerated only in the past few years. As a result, the market lacks a successful track record and shows a shortfall of IPOs, and consequently, traditional equity investors are unaware of market opportunities. Many funding providers don’t have the tech expertise combined with the risk appetite to invest in sustainable textiles innovations. Investors need to be made aware of the vast opportunities to make them more willing to invest the funds needed to scale-up existing technologies and create innovations.

As the first venture fund exclusively focused on circular and bio-based industries in Europe, ECBF believes in the potential of sustainable textiles and textile tech to reduce carbon emissions while generating favorable financial returns and investment opportunities. We seek to be a significant financial instrument and partner for entrepreneurs looking to unlock and accelerate the economic potential of the circular bioeconomy in Europe, and help create a better and healthier future for everyone

For questions and comments, please refer to

Jowita Sewerska, Investment Director at ECBF

jowita.sewerska@ecbf.vc

Jisk de Vries, Analyst at ECBF

jisk.devries@ecbf.vc

Cornelia Mann, Marketing & Communications at ECBF

cornelia.mann@ecbf.vc